CORPORATE AFRICA

Corporate Africa was founded in 1994 to guide investors and businesses to opportunities across Africa, and connect local content and governments with investors in their chosen markets. Corporate Africa also facilitates partnerships and collaborations strengthening corporate brands and messages in target markets to influence commercial and political personalities controlling resources inside growth industries such as infrastructure and health and Medicare.

Africa Power & Energy Symposium 2024

Africa Trade and Investment Mission

Corporate Africa is an investment platform with experience across all African nations, matching governments and corporations with trade and investment opportunities. Since 1994 Corporate Africa has been a preferred choice for companies and governments wanting access to investment and matchmaking opportunities. The advent of the BRICS in 2009 and the BRICS Africa Business Investment Guide in 2013, has created greater capacity to exploit the breadth and depth of BRICS member countries’ economy, industries, and markets for additional partners, finance, technology, and investments. Click Here to connect

Projects Conferences and Exhibitions

Special reports are the spine of Corporate Africa. They connect investors to opportunities and governments seeking international capital. Reports cover the breadth and depth of Africa’s industry sectors, including green infrastructure, regional projects, and key players’ services and solutions. In between customers’ profiles they are subsequently inserted into delegates’ bag and at Registration in major events to generate conversations which are continued Online at: https://corporate-africa.com/africa-trade-investment-mission/ Please go to the “Events” link to see MICE for 2023/2024. Click here to connect

Corporate Africa Energy Academy

Corporate Africa Energy Academy interactive seminars are designed to empower energy professionals by furnishing them with the skills and connections required to spearhead their national and regional renewable economies. The courses addresses the state of Africa’s energy industry; the transition from fossils to carbon-free economies, and partnerships and skills necessary to bridge the gap from fossil fuels to carbon free energy. Courses will be held alongside major energy events and will examine the current stage of transition in targeted economies. Click here to Register and attend.

Corporate and Business Services

Mr. Timothy Onayemi

INDUSTRY INTELLIGENCE

Senior Correspondent

Professor Ken Ife

GOVERNMENT RELATIONS

Chairman Corporate Africa Conferences

Mdm Therese Lethu

PRIVATE PUBLIC PARTNERSHIPS

Global Health Specialist

Mr. Emile Jose Fernandes

BUSINESS PARTNERSHIPS

Sofreco, Regional Director

Ms. Kellie Whitlock

MEETINGS AND CONFERENCES

Event Organizer

Ms. Angelina Nalobo

EXHIBITIONS AND EXPOS

Promotion Director

Mr. Melaine Kouassi

FRANCOPHONE AFRICA

Aviation Transport Specialist

Mr. Michael Ampe Kofi

WEST AFRICA REGION

Director West Africa

Ms. Jian Sun

CHINESE INVESTMENTS

Special Project Director

Past Projects

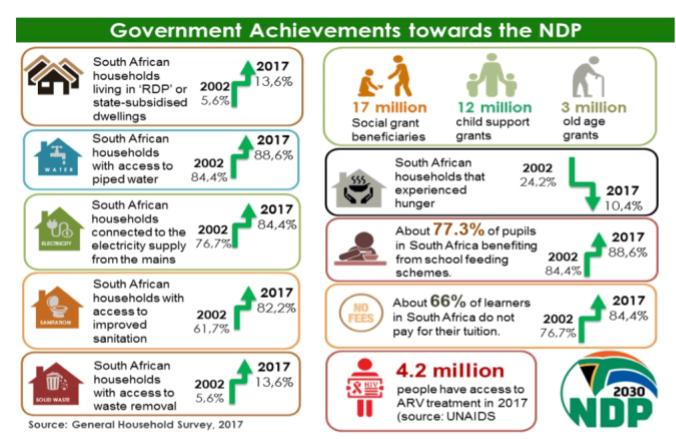

South Africa Reconstruction and Development Program

Corporate Africa and the Government of South Africa provided content outlining the country's development plan to build capacity across national infrastructure to satisfy the needs of disadvantaged Africans. Also, to attract former and new investors back into South Africa economy through a global marketing campaign showcasing opportunities across the nation businesses and industries targeting foreign investors in the United Kingdom, the USA and European Union.

Partnerships for Prevention and Care Africa Health Campaign and Conference

A private public partnership project organised in partnership with governments of Ghana, Kenya and Nigeria to measure the impact of HIV/AIDS, TB and Malaria in their countries, the levels of stigmas and implement and coordinate national response strategies including testings, transfers of life science investors’ health and Medicare technology and science in key health facilities in these countries.

G-20 Africa Infrastructure Investment Conference

This is an international biannual project partnered by hi-level representatives from the G20 Steering Group, the UK Office for International Development, African Trade Ministers together with investors to discuss Africa infrastructure development, goals, projects and programs, and access to finance packages throughout the 21st century.Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

China Africa Business Summit

The Summit was organised in partnership with the PRC to engage and deliver opportunities, technologies, and the services of businesses from China to African governments and companies seeking greater cooperation and partnerships with China and its business communities.

Africa Green Investment Gateway Conference

A powerful and timely international meeting organized by Corporate Africa covered by CNN; embracing African governments and Green Technologist, investigating the impact of climate change in Africa and the technology, finances and other resources required to build low carbon economies. Covered by CNN International